No delays for vessel carrying MEG at Port Qasim

Ibrahim Fibers Limited is the largest importer of Mono Ethylene Glycol(MEG) in Pakistan since two decades. This is used for producing Polyester Fiber at their textile manufacturing facility at Faisalabad. Vessels carrying MEG are destined to Marginal Wharf 1 (MW-1) jetty, which routinely remain occupied with other vessels; thus vessels carrying MEG had to wait in queue for extended period of time entailing substantial demurrage. Although Ibrahim Fibers have a storage facility of 12,000 MT at Port Qasim but to avoid long delay and financial burden they used to take cargo delivery at Kemari Karachi. Under an arrangement with Engro Vopak supply line, Ibrahim Fibers had paired with EVTL pipe line connecting their storage facility, with this new arrangement vessel with MEG will not experience delay and will be off loaded and turn around timely the cargo will land directly in storage facility of Ibrahim Fibers. The first ship to utilize this facility was “Southern Wolf” which safely berthed on Feb 7 with 4000 MTs of MEG cargo from Shuaiba under the agency of Alpine Marine Services.

|

Bank advances, deposits and investments jump

The bank deposits grew by 17 per cent to Rs19.9 trillion during the last 12 months from January 2021, the State Bank of Pakistan (SBP) reported. Bankers found it very attractive as the increased deposits mean the banks earn more. The balance sheets of all scheduled banks showed they earned healthy profits during the calendar year 2021. The increased liquidity also supported the private sector which borrowed record money during this period. However, the higher deposits helped the banks to invest more in the government papers to earn risk-free profits. The data shows the banks’ investment increased by 26pc to Rs14.4 trillion in January compared to Rs11.4tr in January 2021 as the government relies entirely on banks for domestic borrowing. Recently, the government changed its strategy and started borrowing more from the non-bank sector like insurance and other corporate sectors. The government is facing liquidity problems due to restrictions from IMF not to borrow from the central bank since 2018. Banking is one of the best profit-making industries while it achieved sustainable growth in an economy where most of the sectors are vulnerable.

|

Rs273bn cleared for Karachi Circular Railway

The Central Development Working Party (CDWP) on Feb 10, cleared a total of three development projects with a cumulative estimated cost of about Rs280 billion, including the Karachi Circular Railway (KCR). The meeting finalised Rs273.071bn the cost of KCR as a modern urban railway project and requested the Executive Committee of the National Economic Council (Ecnec) to approve its implementation in the Public-Private Partnership (PPP) mode on a build-operate-transfer basis. An official statement said the 43-km dual track of the Urban Rail Mass Transit System will be constructed in a period of three years on a PPP basis. The main objective of the project is to provide reliable, safe and eco-friendly public transport to the metropolitan city of Karachi. The project is expected to serve a daily ridership of 457,000 which is expected to increase to one million a day by the end of the 33-year concession period. It will deploy the use of electric trains and will be operational round the week. The project involves 30 stations along the corridor covering the most densely populated areas of Karachi.

|

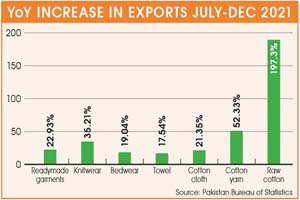

Exports to US, China, UK surge

The United States remained the top export destination of Pakistani products during the first six months of 2021-22, followed by China and the United Kingdom. Total exports to the US increased by 45.95 per cent to $3.32 billion during July-December 2021-22 against $2.27bn in 6MFY21, according to data released by the State Bank of Pakistan (SBP). Exports to China grew by 59.05pc to $1.33bn against $837.91 million in the corresponding period last year. The UK was the third top export destination showing an increase of 19.79pc to $1.14bn in 6MFY22 against $956.524m in the same period last year. Among other destinations, exports to the United Arab Emirates grew by 24.67pc to $869.26m against $697.24m in 6MFY21 while the exports to Germany were recorded at $864.18m against $748.79m last year, the SBP data showed. During July-December 2021-22, the exports to The Netherlands were recorded at $682.45m against $516.10m whereas goods worth $488.689m were exported to Italy against $355.29m. Exports to Spain rose to $508.33m in 6MFY22 against $362.782m in the corresponding period while the exports to Afghanistan plunged to $240.504m from $450.77m in 6MFY21.

|

World Bank seeks ‘actions’ for 2nd phase of loan plan

The World Bank has sought at least four crucial ‘prior actions’ for the second phase of a multi-million dollar loan programme to advance the reform process – Resilient Institutions Strengthening Programme (RISE-II). The key prior actions would require the authorities to ensure harmonisation of General Sales Tax (GST) among the federal and provincial governments, control rising debt burden through amendments to the Fiscal Responsibility & Debt Limitation Act 2005, bring uniformity in provincial property valuations for tax purposes and ensure complete clearance of GST refunds. RISE-II is an extension of an earlier programme approved in 2019 and is meant to support measures to enhance the country’s fiscal position and promote competitiveness and growth through harmonisation of the GST, increased use of digital financial services, and enhanced integrity in the financial sector. Under the current system, the sales tax base is fragmented, with services subject to provincial taxation and goods under federal government taxation. The fragmentation of the tax base has severely compromised tax policy design and administration, generated disagreements over tax base definition and crediting, caused cascading and double taxation for businesses, and significantly increased compliance costs.

|

Extraction of lignite coal deposits begins in Thar’s Block 1

Sino-Sindh Resources Ltd (SSRL) said on Jan 31 it successfully extracted the first shovel of lignite coal at Block 1 of the Thar coalfields near Islamkot Town of Tharparkar, Sindh. Block 1 boasts lignite coal deposits of over three billion tonnes (equivalent to over 5bn barrels of crude oil) with an annual output of 7.8 million tonnes. As soon as the two governments officially announced the China-Pakistan Economic Corridor, the Thar coal project was included in it as an early-harvest project. According to the Thar Coal Energy Board, SSRL and Shanghai Electric Group have already signed a coal supply agreement for power generation through two mine-mouth power plants of 660 megawatt each. SSRL officials said the development of the indigenous resource base at Thar will help Pakistan achieve its long-cherished goal of energy security. Chief Minister Syed Murad Ali Shah also congratulated the officials and workers of the different companies engaged in the mining in the block and termed it a great success of the joint efforts.

|

IMF projects Pakistan’s real GDP at 4pc, advises roll back housing finance and increase utility tariffs

IMF projects Pakistan’s real GDP at 4pc, advises roll back housing finance and increase utility tariffs Pakistan’s economy is set to keep on recovering in fiscal year 2022, with real GDP growth projected at four per cent, the International Monetary Fund (IMF) said on Feb 3 Thursday, hours after approving the continuation of an extended loan arrangement. With this Pakistan can now draw about $1 billion from the fund, bringing total budget support under the programme to about $3bn, or 106pc of Pakistan’s IMF quota. The International Monetary Fund (IMF) has also asked the State Bank of Pakistan (SBP) to “unwind” the two key measures for the promotion of housing and construction activities. The international lender “urged” the central bank to wind down these measures “out of concerns for financial stability”. Banks’ housing lending targets could present risks to financial stability and entail a misallocation of credit. In another advisory the fund has asked Pakistan to increase electricity and gas prices in order to align energy tariffs with cost recovery. IMF stressed that the regular implementation of tariff adjustments in line with established formulas was critical to lend credibility to the newly-independent energy regulator, halt the accumulation of arrears and implement the Circular Debt Management Plan (CDMP).

|

Trade deficit shrinks 30pc in January

The country’s trade deficit shrank 30 per cent month-on-month to $3.36 billion in January, mainly led by lower imports amounting to $5.91bn compared to $7.58bn in December, the Pakistan Bureau of Statistics (PBS) reported on Feb 2. However, the trade deficit widened 92pc year-on-year to $28.8bn during the first seven months (July to January) of the current fiscal year amid rising imports and limited growth in the exports. The PBS data showed that the exports rose to $17.67bn during the seven-month period from $14.25bn a year ago, showing an increase of 24pc. On the other hand, imports jumped 59pc to $46.47bn during July-January from $29.25bn in the same period last year. Addressing a news conference on Wednesday, Finance Minister spokesman Muzzammil Aslam said that during the last few months, the unprecedented increase in the import bill was mainly due to the import of Covid-19 vaccines, sugar and wheat. However, the country now had surplus stocks of sugar and wheat and no longer needed to import these commodities, he said. The inflation in the country had reached at its peak now and it would decline in the coming months along with imports and trade deficit, he added.

|

SBP revises time limit for export proceeds

The State Bank of Pakistan (SBP) has reversed its earlier decision to reduce the time period from 180 days to 120 days to bring exports proceeds into the country. In a circular issued on Jan 5, the SBP said that full export value of goods exported from Pakistan and declared to the Customs authorities should be received in an approved manner, on the due date for payment or within one hundred and twenty (120) days from the date of shipment, whichever is earlier. However, a circular issued on Feb 1 by the SBP clarified that amendments introduced through the earlier FE circular shall not be applicable on such exports where irrevocable letters of credit with usance (time for payment of foreign bill) period up to 180 days were issued or established up to the date of issuance of above instructions. This decision was taken in view of the representation received from various Authorised Dealers (ADs), Chambers of Commerce and Industries and Exporters’ Associations, and to help exporters to fulfill their commitments, said the SBP.

|

Local cement sales, exports plunge

The local cement sales dropped 16 per cent year-on-year to 3.4 million tonnes followed by a 21pc fall in exports to 551,006 tonnes in January. All Pakistan Cement Manufacturers Association (APCMA) spokesman said that slowdown in the construction activities for public sector development projects amid unfavourable weather conditions is one of the key causes of lower domestic consumption of cement. He said the huge fall in exports is a matter of concern for the government too as it is negatively impacting the much-needed foreign exchange for the country. “One of the main reasons for low exports via sea is the shortage of containers while an increase in demand for containers has resulted in rising freight cost of containers from $500 to $1,500, making the Pakistani cement uncompetitive in the international market,” he said. The overall cement sales (local and exports) shrank 16.6pc year-on-year to 3.95m tonnes. He said the cement industry was already under pressure due to a sharp increase in the production cost that includes global coal prices, high power tariffs and transportation.

|

Black rice makes its way to Pakistan

The government’s export promotion policies are bearing fruit as businessmen are looking forward to diversifying their exports and introducing new varieties of products. An ancient Chinese royal food - black rice - has made its way to Pakistan and it has the potential to fetch three times greater export revenue for the country. Black rice has been successfully cultivated in Jacobabad - the border area of Sindh and Balochistan - after conducting prior research. This variety of rice, being a royal food, was once forbidden for the common people. Black rice contained 28 antioxidants. this variety had a huge export potential, as India had been exporting this type of rice on a large scale since 2017. Rice is the second biggest export product of Pakistan after textile. Sindh Abadgar Board Vice President told, “although these seeds are more expensive and untested, they are increasingly becoming popular now owing to their high-yielding capability,” he underlined. “There is no doubt that if the government supports this new variety of rice, it will fetch significant export revenue for Pakistan.” Black rice had a huge demand in the international market. Thus, Pakistan has a massive export potential if this variety is cultivated successfully across the country.

|

Inflation skyrockets to two-year high level

The inflation rate steeply rose to 13% in January – the highest level in two years – due to a surge in prices of food, housing and transport, as the country also starts to embrace the worst impact of the inflationary mini-budget. The Pakistan Bureau of Statistics (PBS) on 1st February reported that the Consumer Price Index (CPI)-based inflation rate jumped to 13% in January over the same month a year ago. It was also the fifth consecutive month that the inflation rate constantly increased, largely due to administrative decisions of the government. The 13% annual inflation rate is the highest since January 2020 when it had been recorded at 14.6%. The government’s administrative decisions coupled with steep currency depreciation are making food, electricity and transport unaffordable for the common man. After failing to rein in the price movements, the federal government has now entrusted the State Bank of Pakistan to ensure domestic price stability under a condition of the International Monetary Fund. For the current fiscal year, the government had set the inflation target at 9%, which it has failed to meet since October last year when the reading shot to 9.2%. The central bank has also revised upwards its inflation projection to 11% but it was the consecutive third month that the inflation rate remained above that level too. The Wholesale Price Index jumped to 24% in January, indicating that prices would remain very high in the coming months. The Sensitive Price Index, comprising goods largely used by the poor and lower middle income groups, also remained at 20.9%, according to the PBS. The latest inflation reading suggests that prices have gone out of the control of the government.

|

|

© 2022 Alpine Marine Services Private Limited

all rights reserved

|

|

|