PM Shehbaz orders coal import from Afghanistan

In a bid to produce cheap electricity to provide relief to domestic consumers and industries, Prime Minister directed the authorities concerned to import coal from Afghanistan. Presiding over a meeting, the prime minister approved the import of high-quality coal from Afghanistan in rupees instead of dollars to save the country’s precious foreign exchange. “This will not only generate cheap electricity but also help save the country’s precious foreign exchange,” he was quoted by the Prime Minister Office as saying. The prime minister ordered improvement in the transportation of coal to be imported from Afghanistan. He also directed the Ministry of Railways to take all necessary steps to ensure prompt delivery of the imported coal to power plants. PM Sharif also issued the directive for forming a committee of officials concerned headed by Defence Minister to expedite the import process of coal. During the meeting, the prime minister was informed that the import of coal initially required for Sahiwal and Hub power plants from Afghanistan would save over $2.2 billion annually in the import bill. Expressing concern over the rising price of coal in the international market, the prime minister termed it the main reason for the costly power generation from coal-based power plants in the country.

|

Pakistan fails to attract bidder for three LNG slots

Amid widespread electricity shortages, Pakistan failed to find a bidder for three LNG slots and received the highest-ever rate for another slot for the last week of July as European customers lap up spot market quantities to compensate for Russian supply disruption. State-run Pakistan LNG Ltd (PLL) floated a tender on June 16 for four cargos — one each in the first and second weeks, and two in the last week, of July. No bidder came up for July 2-3, July 8-9 and July 25-26 delivery windows. This was the third futile attempt by PLL to have an LNG cargo in the first week of July. The earlier two tenders issued on May 31 and June 7 attracted two and one bidder, respectively, but none was technically responsive. Hence, the bids were returned unopened. The only bid this time for July 30-31 was from QatarEnergy Trading. It came at a record-high price of $39.8 per million British Thermal Unit (mmBtu). Sources said it’d be a challenging for the government to accept such a high rate and that it should go for load shedding or maximise generation from other fuels. The highest-ever bid that Pakistan accepted since it started LNG imports in 2015 was at $30.65 per mmBtu in November 2021. The sources said suppliers in the spot market, besides producers in the Middle East, have been influenced by the US government to ensure maximum LNG supplies to the European countries that were ready to lift the commodity at any price to meet shortages caused by supply disruptions from Russia. On the other hand, PLL has sought a total of Rs278bn for four months, including Rs98bn in the current month, Rs44bn in July, Rs80bn in August and Rs56bn in September.

|

10% ‘super tax’ imposed on rich

The government on Friday announced to impose Rs200 billion in additional taxes on the richest persons and the salaried class, taking the total new taxation to a record over Rs1 trillion introduced in the budget aimed at securing a deal with the International Monetary Fund (IMF). In his budget windup speech, Finance Minister announced to impose from 1-10% ‘one-time super tax’ on the big firms to collect an additional Rs80 billion from them. Minutes before the finance minister’s speech, Prime Minister while explaining the rationale behind the aggressive measures in a pre-recorded address to the nation said it was a transformational effort to make the richest pay their share so as to cushion the shock of recent austerity measures to the poor. The prime minister added three more sectors to the list of industries that would be subject to 10% super tax, taking the number from 10 sectors to 13. However, the stock market bulls blasted off minutes after the premier’s announcement of the super tax and immediately crashed by losing 2,053 points or 4.8% of the value. Subsequently, the losses were reduced to 1,666 points.

|

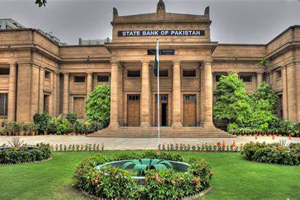

Central bank receives $2.3b Chinese loan

Pakistan received the much-awaited Chinese commercial loan of $2.3 billion on Friday, The Chinese loan, which has been rolled over, is the first significant inflow in the past six months that has increased the country’s capacity to make international payments and avert the chances of default on import payments and foreign debt repayment. The country’s foreign exchange reserves had depleted around $8 billion in the past six months to a 32-month low at $8.23 billion in the week ended June 17, 2022, the central bank reported in its latest update on 23RD June.

|

Banking sector expands 19.6pc

The banking sector posted a growth of 19.6 per cent particularly due to much higher private sector participation in the economic growth during the calendar year 2021, said the State Bank of Pakistan (SBP). According to report, the financial sector’s asset base expanded by 15.6pc in CY21, while financial markets observed a relatively contained volatility compared to last year. The banking sector— the major part of the financial system—posted strong growth of 19.6pc (14.2pc in CY20), which was particularly aided by a surge in private sector advances. The expansion was well supported by healthy deposits growth of 17.3pc, while banks also increased reliance on borrowing from the banking system, said the report, adding that the credit risk of the banking sector remained contained as gross NPLs (non-performing loans) ratio declined by 130 basis points to 7.9pc. Accordingly, the net NPLs ratio declined to 0.7pc, indicating lower residual risk to the solvency from delinquent loans. “On the performance front, the earning indicators observed improvement as ROA (return on assets) stood at 1pc and ROE (return on equity) improved to 14.1pc,” said the report. Due to the improved earnings, banks’ solvency remained strong as reflected in the high Capital Adequacy Ratio of 16.7pc that stayed well above the minimum domestic regulatory benchmark of 11.5pc and international benchmark of 10.5pc, it added.

|

OGDC discovers oil and gas

Oil and Gas Development Company Ltd (OGDC) told investors it has discovered oil and gas in the exploratory well named Nim East-1 in Tando Allah Yar district of Sindh. Drill Stem Test-1 (DST) in the Basal Sand has tested 1,400 barrels of oil per day (bopd) and 5.02 million standard cubic feet per day (mmscfd) gas. Additionally, the company said it has made a separate gas discovery at Kaleri Shum-1 well located in Rajanpur (tribal area) of Punjab. Earlier gas discoveries were reported in Guddu Block well called Umair South East-1 in Ghotki district of Sindh — in which the company is an operator with a 70 per cent stake. “The discovery of Umair South East-1 is the result of aggressive exploration strategy adopted by Guddu Joint Venture Partners. It has opened a new avenue and will positively contribute to mitigating the energy demand and supply gap from indigenous resources,” the company said.

|

Mobile phone assembly units may shut down

Operations at major mobile phone assembly plants are on the verge of halt as the letters of credit (LCs) for import of completely knocked down (CKD) units are not being opened due to the shortage of dollars since May 20 and the industry is facing the depletion of raw material inventory. The State Bank of Pakistan (SBP) through its tweet clarified that it had not stopped import payments and commercial banks had sufficient dollar liquidity to make the payments. Indeed, import payments of around $4.7 billion have been executed through the inter-bank market during the current month so far. There is a growing anxiety among the manufacturers and businessmen over the crisis due to LC restrictions, allegedly caused by the scarcity of dollar in the market. Banks are not opening LCs for mobile phone CKD units due to shortage of dollars since May 20, jobs of almost 50,000 people working in the industry are at risk.

|

Payment restrictions hit auto sector’s production

Auto parts makers and vendors have started facing production challenges due to the restrictions imposed by the State Bank of Pakistan (SBP). The industry says it has been encountering a production crisis following the curbs put in place through Circular No 09 of 2022. “These restrictions are hurting original equipment manufacturers (OEMs) and auto parts makers. We need relief from the government and policymakers but instead we are being crippled through various kinds of measures,” remarked Pakistan Automotive Manufacturers Association. The SBP issued the circular on May 20, introducing a mechanism that required prior approval of the central bank for the import of certain goods. The circular also demands letter of credit, registration/ amendment contract, advance payment, and authorising transactions on an open account or collection basis. The prior approval of the SBP is also applicable to all import transactions under HS Code 8703 (completely knocked down units of motorcycles).

|

Large-Scale Manufacturing output shrinks 13.3pc in April

In the first month of the PML-N-led coalition government, the Large-Scale Manufacturing (LSM) shrank month-on-month by 13.3 per cent in April, the Pakistan Bureau of Statistics (PBS) reported. The big industry posted a robust growth of 26.6pc in March, the last month of the PTI government. However, the LSM grew year-on-year 15.4pc in April. The production estimation for LSM industries was made on the new base year of 2015-16. However, the PBS also released a separate estimation with old base of 2005-06. As per the old base 2005-06, the LSM grew by 5.3pc in April compared to a year ago. On a month-on-month basis, the industry’s production declined by 22.8pc. The calculations in both estimations show a downward trend as LSM entered a negative growth on a month-on-month basis. In the first 10 months (July-April) of the current financial year, LSM grew by 10.7pc on a year-on-year basis as per the new base. However, the growth is calculated at 6.7pc in the 10 months on the basis of the old base-2005-06. The PBS snapshot of manufacturing activity showed that seven out of 15 sub-sectors in the LSM dipped in April. High-interest rates and depreciation of the rupee have increased the cost of raw materials further, and economic activity is expected to slightly slow down during the current financial year.

|

World Bank lends $85mn to support low cost housing

Pakistan and the World Bank signed a deal worth $85 million for Pakistan Housing Finance Project. Secretary, Ministry of Economic Affairs and Gailius J. Draugelis, acting country director, World Bank signed the financing agreement while representative of Pakistan Mortgage Refinance Company (PMRC) signed the project agreement. World Bank Gailius, ensured the Bank’s continuous financial and technical assistance to Pakistan to help promote inclusive and sustainable economic growth in the country. The primary beneficiaries of the project will be low- and middle-income households in Pakistan reliant on informal incomes. Pakistan Housing Finance Project is aimed at supporting the ongoing efforts of the government in increasing access to housing finance for households and support capital market development in Pakistan. The additional financing will fund the initial capitalization of sub-trust of the Risk Sharing Facility created under the parent project of $140 million being executed by Pakistan Mortgage Refinance Company. The project will enable the Primary Mortgage Lenders (PMLs) to move from the very upper end of the households in the 5th quintile to lower quintile income groups.

|

Italy becomes a ‘Billion Dollar’ export market for Pakistan

At a time when Pakistan’s economy is struggling with ever widening trade deficit, some of our export markets are displaying exceptional growth. Italy has become ‘billion dollar’ export market for Pakistan for the first time ever. In the first 11 months of this year, our exports to Italy increased 46% which is highest growth rate among all of our export destinations in Europe. In this period, Pakistan’s trade surplus with Italy has increased 84%. Just three years ago, Pakistan actually had a trade deficit of $148 million with Italy. In the last three years, despite the pandemic driven market disruptions, Pakistani trade with Italy not only recovered from the deficit but has turned around to post a trade surplus of half a billion dollar. Pakistan’s exports to Italy have crossed $ 1002 million during the first 11 months of this financial year with the value added sectors becoming the main driver of growth that has produced a trade surplus of around half a billion dollar. That too at a crunch time for the country reeling from record trade deficits. From an increasingly diversified export basket, home textiles, leather, rice, plastic products, surgical instruments, general fitness equipment and auto-parts have been the top performing product lines. In the wake of the pandemic led health consciousness, Pakistan’s exports of articles of general fitness have also increased by over 100%, while export of plastic products has increased 356%, making Italy Pakistan’s 4th largest export destination for plastic products.

|

|

© 2022 Alpine Marine Services Private Limited

all rights reserved

|

|

|