Newsletter - Publication 95

15th Jan 2021

|

|

Pakistan launches first instant payment system to strengthen formal economy

Prime Minister Imran Khan launched Pakistan’s first instant payment system – Raast – to enable end-to-end digital payments among individuals, businesses and government entities instantaneously. The prime minister, while addressing the gathering, termed the launch a major step forward by the State Bank of Pakistan towards Digital Pakistan, and said it would help include the low-income groups and make them part of the mainstream economy. He was optimistic that it would go a long way in fighting poverty, particularly in the rural areas. Raast is part of Prime Minister Imran Khan’s Digital Pakistan vision to include poor segments of the society in formal economy. The faster payment system will be used not only to settle small-value retail payments in real time but also provide cheap and universal access to all players in the financial industry, including banks and fin-techs. PM said the instant payment system would not only document the economy, but also generate more taxes to help build the country. SBP Governor said the government employees and pensioners would be able to get payment of salaries and pensions in seconds. It would cut down on the delays in that regard. He said it would also allow help curb corrupt practices and provide simple, secure and transparent transactions.

|

|

Car sales jump 13pc in 1HFY21

Barring heavy commercial vehicles (HCVs), the entire auto sector gave a brisk performance during the first half of current fiscal year (1HFY21) on account of low interest rates and better farm incomes. Buyers purchased more number of vehicles despite rising price trend in vehicles amid low cost of imports owing to a stronger rupee against the dollar from the last week of August 2020 — at Rs168 — compared to the current rate of Rs160 in the inter-bank market. Car sales jumped by 13.4 per cent to 67,026 units followed by 134pc in jeeps, 32.4pc in light commercial vehicles (LCVs), 43pc in farm tractors and 19pc in two/three-wheelers. Demand for cars would grow stronger owing to low interest rates environment and pickup in economic activities. In HCVs, a total of 1,650 trucks were sold in 1HFY21 versus 1,704 units in the same period last fiscal In buses, total bus sales of Pama members stood at 297 units as compared to 373 units.

|

|

Construction on ‘Strategic Underground Gas Storages’ to start in August

The government has planned to construct the Strategic Underground Gas Storages (SUGS) in August this year to meet the increasing gas demand in future, which were considered mandatory along with the import of LNG as per international practices. “Feasibility study of the SUGS is scheduled to be completed in May, while construction on these facilities will start in August 2021,” a senior official privy to petroleum sector developments told. The construction of SUGS was part of the government’s policy to improve energy security and affordability in the country, adding “the SUGS is aimed at meeting the country’s growing domestic and commercial needs especially during peak winter months of November, December, January and February.” The underground facilities, he said, would be constructed in collaboration with the Asian Development Bank (ADB). A consortium of European oil and gas equipment companies is leading the study in that regard. Explaining the rationale for building the SUGS, he said Pakistan had considered building emergency stockpiles of gas “to deal with supply disruption amid the country’s growing domestic and commercial demand especially in winter.” Recently, he said, all stakeholders held a meeting and agreed to expeditiously complete the study report on the methodology of underground gas storage till May 2021, so that availability of funds for facilities could be ensured in due course of time.

|

|

Pakistan starts production of advanced JF-17 Thunder Block III aircraft

Pakistan Air Force announced the serial production of the 4.5-generation aircraft of the most advanced variant of JF-17 Thunder Block III. The start of production was announced at a ceremony at the Pakistan Aeronautical Complex (PAC), Kamra where the PAF was also handed over the 14 state-of-the-art indigenously developed dual seater JF-17B Thunder Block-II fighter jets. Chief of Air Staff Air Chief Marshal Mujahid Anwar Khan called the the new jets a “significant milestone” in the history of the country. The air chief said that the JF-17 Thunder had been proven as a battle-tested aircraft during the Operation Swift Retort .The ceremony also marked the announcement of serial production of PAF’s most advanced 4.5 generation JF-17 Thunder Block III jets. The air chief commended PAC for the in-time completion of the project by the Aircraft Manufacturing Factory (AMF) team involved in the development of the advance generation of the dual seater JF-17B Thunder and Block-III jets version. The PAF chief lauded PAC Kamra for upholding its traditions despite the most challenging times of the pandemic. “I would like to commend the entire team and PAC leadership including chairman PAC and managing director AMF for their concerted efforts to meet the project deadlines,” said Air Chief Marshal Mujahid. The PAF head said that PAC was the backbone of PAF’s operational readiness and had displayed their capabilities to meet challenges with limited resources at the optimum level. The air chief also extended his gratitude to the Ministry of Defence Production and Chinese Aviation Industry for their continuous support. “The dual seat version of JF-17B and the production of Block-III marks the achievement of a significant milestone as it will play an important and significant role in geostrategic milieu due to the technology installed in the modern aircraft,” said the PAF chief. Speaking on the occasion, Chinese Ambassador Nong Rong said PAC’s successful acquiring of the capacity to build JF-17B Thunder Block-III aircraft has set up a perfect model of Pak-China friendship. “Pakistan has become self-sufficient in developing JF-17 Thunder and an advance fighter aircraft producing country in the world. JF-17 Thunder has finally become the backbone of Pakistan’s defence,” said the envoy. He hoped it would further strengthen the defence ties between Pakistan and China. “Pakistan and China’s close collaboration will bring more success in the future.”

|

|

PLL again invites bids for LNG terminal capacity

Pakistan LNG Limited (PLL), after rejecting bids in the first round, has floated a second tender in a bid to allocate idle capacity of a liquefied natural gas (LNG) terminal to the private sector. Earlier, PLL had issued a tender, seeking to earmark terminal capacity to the private sector for LNG import. However, the company management tactfully knocked out the private sector by consuming two contract cargoes in November, which were scheduled for December and January. PLL has contracts with Gunvor and Eni for supply of one LNG cargo each every month. However, it consumed contract cargoes in those months when LNG prices were low and preferred to import gas through spot contracts at the most expensive rates offered by importers for deliveries in January and February 2021. Owing to that, the private sector was not able to import a single LNG cargo as bureaucratic hurdles stood in their way, which helped gas companies to maintain their monopoly. Chairman of the Cabinet Committee on Energy has already announced the creation of a competitive gas market through LNG imports by the private sector. However, bureaucratic snags have forced gas consumers to cough up millions of dollars annually in capacity charges to the LNG terminal operator for the idle capacity. Now, PLL has again invited private sector investors to bid for the unutilised terminal capacity for a short term of six months (February-July 2021). News Channel reported that Pakistan’s Oil and Gas Regulatory Authority (OGRA) has issued today 10-year term LNG importing licenses to at least two private sector companies.

|

|

Trade deficit widens 32% in Dec

Pakistan’s trade deficit widened nearly one-third in December 2020 despite a much-trumpeted increase in exports, which was not sufficient to match the surge in imports that jumped to over one-and-a-half-year high of $5 billion. The gap between imports and exports increased to $2.7 billion in December over a year ago, a jump of $651 million or slightly above 32%, the Pakistan Bureau of Statistics (PBS) reported. The 32% increase in deficit was due to the spike in imports that overshadowed a gradual improvement in exports. In December 2020, imports surged to $5 billion compared to $4 billion in the same month of previous year, which reflected an increase of 25.2% or $1.01 billion. The $5 billion worth of imports were the highest in the past 19 months. Last time in May 2019, the imports had amounted to $5.04 billion. Exports showed a significant improvement and surged to $2.35 billion in December, an increase of 18.3% or $364 million. But the increase was not sufficient to contain the trade deficit. The government has already missed the annual export target in its first two years. For the current fiscal year, it has set the export target at $22.7 billion, which will require 6.2% growth. Imports registered an increase of 16.8% and stood at $5 billion last month. In absolute terms, there was an increase of $724 million in the import bill last month. As a result, the trade deficit widened 25.6% or $546 million in December over November.

|

|

KE granted licence for pipeline

Amid opposition from the Sui Southern Gas Company Ltd (SSGCL), the Oil & Gas Regulatory Authority (Ogra) granted a licence to K-Electric to construct and operate a 2.4km pipeline for transportation of natural gas/liquefied natural gas to its upcoming 900mw power plat at Bin Qasim. Under the licence, KE is now entitled to construct and operate 14-inch diameter gas pipeline of 2.4km for transmission of natural gas or regasified LNG from tie-in point in SSGCL’s custody transfer station at Port Qasim to its Bin Qasim Power Complex. The pipeline would have the capacity to transport 250 mmcfd of gas with an estimated capital expenditure of $4million. The SSGCL management had opposed the licence to KE. It said the KE was a major defaulter of SSGCL with Rs116bn payables including Rs86.3bn late payment surcharge build over July 2012 to July 2020. “If KE is allowed to lay down and operate this pipeline then it is most likely that they would never pay off the outstanding balance towards SSGCL as they would no longer require SSGCL’s supplies,” the utility said. This would also cause huge financial loss to SSGCL, it added. It also pleaded that since the location of supply of regasified liquefied natural gas (RLNG) to KE was at the very start of the entire RLNG infrastructure, therefore any abruption or surge due to operational variations of KE will directly affect the RLNG operations and its infrastructure across the country. Moreover, the SSGCL had already demanded 600mmcfd gas from second LNG terminal to meet peak demand in various sectors. However, Ogra overruled these objections.

|

|

20.76m lost livelihood due to lockdowns: survey

Pakistan’s 20.76 million workforce suffered livelihood losses due to coronavirus-related lockdowns and a large majority of them got back to work after July 2020, an official survey reveals. The Planning Commission said the country’s 35 per cent (about 55.74m) population of 10 years and older was working before the onset of Covid-19, but due to closure of activities after implementation of lockdowns, this declined to 22pc (about 35.04m people). “This means almost 20.76m population was affected,” the commission said, citing the survey conducted by the Pakistan Bureau of Statistics (PBS), after July the recovery process started and 33pc of population reported working after April-July 2020. This means approximately 52.56m people started working again — almost a V-shaped recovery. Livelihood of 17.07m households was affected due to lockdown restrictions. The survey evidence suggested that had the strict lockdown continued, devastating impacts might have been observed on the livelihoods of vulnerable groups of workers and their families.

|

|

Physical work’ on PARCO coastal refinery to start soon

The government has planned to start ‘physical work’ on the much-delayed Pakistan Arab Refinery Company (PARCO) Coastal Refinery before the next summer to achieve self-reliance in the oil production sector. “All formalities including refinery’s design, licensing, engineering work, sizing and product-slab have been completed. Hopefully, the physical work on seven-billion dollar project would start before next summer after its formal groundbreaking,” a senior official privy to petroleum sector developments told. The refinery, approved in October 2007 but remained suspended due to paucity of funds, would have the capacity to refine 250,000 barrels BPD, equal to 13 million tons of petroleum products per annum. He said the present government was working on a prudent strategy to achieve self-reliance in the oil refining sector by upgrading the existing facilities and establishing new deep conversion refineries in different parts of the country. According to an official report, currently, as many as five refineries are operating in the country with an overall installed capacity of 417,400 barrel per day (BPD) oil and contributing significantly in meeting the petroleum needs through indigenous production. Out of which, Pak Arab Refinery Limited (PARCO) has 100,000 BPD oil refining capacity, Attock Refinery Limited (ARL) 53,400 BPD, Byco Petroleum Pakistan Limited (Byco) 150,000 BPD, National Refinery Limited (NRL) 64,000 BPD and Pakistan Refinery Limited 50,000 BPD.

|

|

State Bank alarmed by pension bill

Public sector pension expenditure has risen sharply over the past decade and the unfunded nature of pension payments in the country is making the current structure unsustainable, the State Bank of Pakistan said in its first quarterly report of FY21. The overall pension spending as a share of tax revenue has reached 18.7 per cent as of FY20, almost double the level a decade earlier. The report said this increasing pension burden is mainly because of two factors; increases in life expectancy extending the duration of pension support and lower-than-expected investment returns (owing to very low interest rates, for instance) that could further lead to a funding shortfall. Says spending rose to 18.7pc of tax revenue during the last decade. The higher pension amount could result in crowding out other valuable spending avenues; “pension spending as a percentage of total budgeted expenditures for FY20 exceeded health and education spending on both federal and provincial fronts and is almost half the level of consolidated development expenditures.” In this regard, international financial institutions such as the World Bank and the International Monetary Fund have also started flagging the rising expenditure as a pressing concern for the country’s debt sustain¬ability, said the SBP. The SBP suggested a number of policy measures to reduce the burden of pensions on fiscal space.

|

|

ECC okays removal of customs duty

The Economic Coordination Committee (ECC) of the cabinet has approved the removal of additional 2% customs duty on 152 tariff lines, mostly raw material, under the National Tariff Policy 2019-24. The ECC approved the summary with the directive that the budget cycle must be observed while considering important incentives for businesses and industries for a smooth planning and subsequent implementation during the financial year. The commerce ministry calculated the financial impact of removal of additional customs duty at Rs550 million. Earlier, the ECC had deferred its approval following opposition from the Federal Board of Revenue (FBR) to the removal of additional customs duty from 152 tariff lines. The FBR argued that the economic decision-making body had proposed to approve it in the last quarter of fiscal year. However, Adviser to Prime Minister on Commerce persuaded the finance ministry and the FBR to agree on the matter. Therefore, the ECC gave the go-ahead to the proposal.

|

|

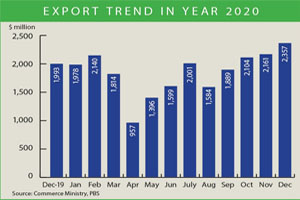

Exports jump 18.3pc in December

Pakistan’s exports grew for the fourth consecutive month in December to $2.357 billion, up 18.3 per cent from $1.993bn in the corresponding month last year, data released by the Ministry of Commerce showed. However, the December export proceeds posted a growth of 8.4pc when compared with $2.174bn in November 2020. The increase in overall exports is mainly driven by double-digit growth in proceeds from textile and clothing sectors as well as engineering products, surgical instruments and value-added leather products. Commerce Adviser said that 18.3pc growth in export proceeds in the month of December is the highest export ever. Between July to December, the export proceeds increased by 4.9pc to $12.104bn as compared to $11.533bn in the corresponding period last year. “This shows the resilience of the economy of Pakistan and it is a vindication of the government’s policy to keep the wheels of economy running during the Covid-19 pandemic”, the adviser said. Exports in the new fiscal year started on a positive note but witnessed a steep decline of 19pc in August before rebounding in September, October, and November. To promote exports of textile and non-textile products, the government is providing cash subsidies besides slashing duty and taxes on import of raw materials. In FY20, exports fell by 6.83pc or $1.57bn to $21.4bn, compared to $22.97bn the previous year. Data shows visible improvements in export orders from international buyers, mainly in the textile and clothing sectors since May.

|

|

POL import bill contracts 22.78pc to $3.946b in 5 months

The imports of overall petroleum group declined by 22.78 per cent during the first five months of the current fiscal year (FY2020-21) as compared to the corresponding period of the last year. During the period under review, the total imports of the petroleum group stood at $3.946 billion, as against the imports of $5.110 billion last year, according to the latest data issued by the Pakistan Bureau of Statistics (PBS). The commodities that contributed to the decrease in petroleum imports included petroleum products, imports of which declined by 16.51 per cent, from $2.174 billion to $1.815 billion. The imports of petroleum cured decreased by 27.01 per cent, from $1.486 billion last year to $1.085 billion whereas the imports of liquefied natural gas decreased by 34.73 per cent from $1.334 billion to $0.870 billion. The petroleum products that witnessed an increase in trade included liquefied petroleum gas, imports of which grew by 52.06 per cent, from $114.905 million to $174.726 million. The imports of all other petroleum group commodities also increased by 8.93 per cent, the data revealed. Meanwhile, on a year-on-year basis, the petroleum group imports decreased by 16.38 per cent during November as compared to the same month of last year.

|

|

|

© 2021 Alpine Marine Services Private Limited

all rights reserved

|

|